Three quarters of employers think their employees aren’t saving enough for retirement, with a similar figure believing the best way to solve low saving levels is through financial education, according to new research/

A survey by Hargreaves Lansdown found employers either underestimate or don’t know how much their employees should be saving for retirement. The data, from research conducted with over 700 employers in January 2016 found 25 per cent of employers are looking to increase their pension contributions, with only 2.4 per cent planning a reduction, while 71 per cent of employers use salary sacrifice, of which a third share their NI saving with staff.

The survey found 76 per cent of employers think financial education is the best way to solve the issue of low contributions, with 46 per cent supporting an increase in minimum auto-enrolment contributions and 32 per cent backing save more tomorrow type contribution increase strategies.

The survey found 76 per cent of employers think financial education is the best way to solve the issue of low contributions, with 46 per cent supporting an increase in minimum auto-enrolment contributions and 32 per cent backing save more tomorrow type contribution increase strategies.

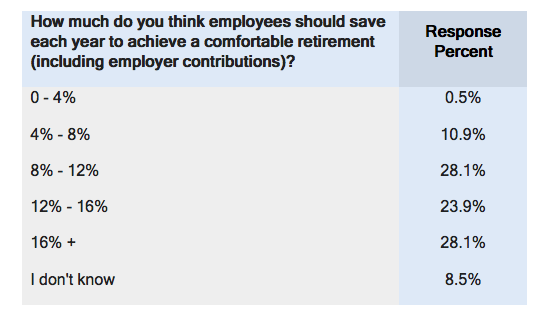

Hargreaves Lansdown senior pension analyst Nathan Long says: “Unfortunately three quarters of employers believe their staff are not putting enough away each month. The reality is worse still, as a large proportion of employers underestimate the amount that should be saved.

Employees need to do a bit more than hope they’ll be alright because they’ve been enrolled into their company pension. Using a pension calculator to understand how much extra they will get by saving a little more now is time well spent.

“Staff at the majority of firms can make contributions free from tax and national insurance using salary sacrifice. Any change to pension tax relief in the upcoming budget could render salary sacrifice unworkable, leaving employees worse off and employers with a lot of unravelling to do.”